The Gray Fox promise is simple: Lead borrowers down a homebuying journey that fits their specific needs. No matter the loan program – Conventional, FHA, VA, USDA, and so on – we’ve got solutions.

Purchasing a Home

Your dream home deserves a dream process. With Gray Fox, experience homebuying that’s transparent, straightforward, and tailored to you.

Refinancing a Home

The right refinancing move can amplify your financial well-being. Lean on Gray Fox's expertise to discover the refinancing solutions that align with your vision and goals.

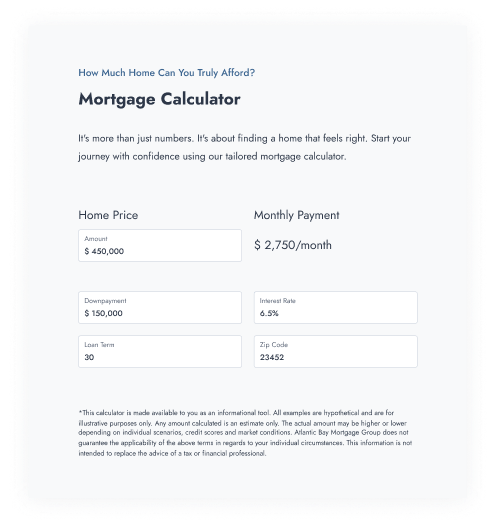

Navigating the housing market starts with understanding your budget. Start your journey with confidence using our tailored mortgage calculator.

Guiding You Home, Every Step of the Way

1 - Pre-qualification

Pre-qualification is the first step in the mortgage application process. By evaluating your credit score, income, and assets, we identify suitable loan programs and estimate your borrowing capacity. This information is for your personal use and does not guarantee loan approval.

2 - Application

The first stage of the approval and loan application process involves the completion of a 1003 residential loan application. Once completed, our team will request items like paystubs, tax returns, W-2 forms, bank statements, and various other items needed to support the information provided on your application.

3 - Underwriting

This is the initial stage of your approval process where all the information gathered is reviewed. Our underwriters work with our processors to verify that the applicant meets all of the criteria of the loan program.

4 - Approval

Once the underwriter finishes their review and determines your ability to meet the requirements of your loan program, you’ll receive feedback on any additional conditions needed for final approval.

5 - Processing

The processing stage is where the items provided with your loan application are verified. Our loan processors will verify employment, review bank statements and credit history, and fulfill any conditions the underwriter needs to clear the loan for closing.

6 - Closing

Once your loan package is fully processed and all conditions have been satisfied, your file is marked “clear to close.” The lender prepares your closing documents, sends all necessary disclosures, and your closing is scheduled with your attorney/settlement agent and realtor, which is typically held at the title company.

Contact a Gray Fox Expert

Buying a home is fun, don’t get us wrong, but there isn’t really a playbook for how to go about it. Here’s the good news: our Mortgage Bankers are ready to share their more than 150 combined years of industry experience with you. After all, transparency is the Gray Fox commitment.